Mirae Asset Securities Extends Overseas, Leading Korean Wave in Customer Asset-Based Finance of 500 Trillion

Jul 30, 2025

Mirae Asset Securities, which operates more than 500 trillion won in domestic and foreign customer assets, is leading the domestic financial business by exporting 'financial Korean Wave'.

Based on the industry's No. 1 equity capital of 12.3 trillion won, domestic financial companies have preemptively entered untapped markets, expanding their global investment horizons to 11 regions.

Mirae Asset Securities' pre-tax profit for its overseas subsidiaries in the first quarter of this year was 119.6 billion won, more than doubling from the previous quarter. Pre-tax profits generated in emerging markets such as India, Indonesia, Vietnam, Brazil and Mongolia, as well as advanced markets such as the U.S., Hong Kong, London and Singapore, more than quadrupled from the previous quarter.

There have been talks in the industry to increase the competitiveness of domestic financial companies, but it has been established as a formula that it is virtually difficult to grow into a global company such as Goldman Sachs, JPMorgan, and Nomura. However, Mirae Asset Securities exceeded that limit and obtained the modifier 'Morgan Stanley of Korea'.

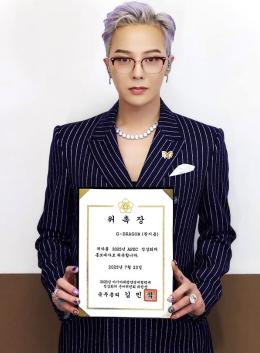

The two companies have the same point as 'Global Investment Company', which is building a wide range of overseas networks among non-bank financial groups in each country. Analysts say that Park Hyun-joo, chairman of Mirae Asset Global Strategist (GSO),'s pioneering plan worked in the background. Chairman Park provides important advice on the group's overseas business, emphasizing long-term values and emphasizing a global investment philosophy based on innovation and market-leading potential. Analysts say that Chairman Park's strategy and independent and systematic management of the securities company's management have exerted synergy.

Mirae Asset Securities is expected to further strengthen its position in the global market based on its global network and strong capital. In fact, Mirae Asset Securities' total capital in the first quarter was 12.3338 trillion won, an increase of nearly 5 trillion won compared to 2023. Since the acquisition of local securities firms in India, it has secured 5.2 million accounts, 130 branches, 3,700 employees, and 4,400 partners to rank ninth in terms of local active customers, while Mirae Asset Securities' overseas customer assets (AUM) soared from KRW 16 trillion to KRW 70 trillion. As a result, the market is predicting that Mirae Asset Securities' growth curve may be steeper than expected.

Mirae Asset Securities plans to expand its presence in the global market by pursuing continuous innovation without settling for the present. It plans to maximize profits through cooperation with global bases within the group, strengthen local internal control systems, and develop customized asset management services using AI (artificial intelligence) technology to increase competitiveness.

Based on the industry's No. 1 equity capital of 12.3 trillion won, domestic financial companies have preemptively entered untapped markets, expanding their global investment horizons to 11 regions.

Mirae Asset Securities' pre-tax profit for its overseas subsidiaries in the first quarter of this year was 119.6 billion won, more than doubling from the previous quarter. Pre-tax profits generated in emerging markets such as India, Indonesia, Vietnam, Brazil and Mongolia, as well as advanced markets such as the U.S., Hong Kong, London and Singapore, more than quadrupled from the previous quarter.

There have been talks in the industry to increase the competitiveness of domestic financial companies, but it has been established as a formula that it is virtually difficult to grow into a global company such as Goldman Sachs, JPMorgan, and Nomura. However, Mirae Asset Securities exceeded that limit and obtained the modifier 'Morgan Stanley of Korea'.

The two companies have the same point as 'Global Investment Company', which is building a wide range of overseas networks among non-bank financial groups in each country. Analysts say that Park Hyun-joo, chairman of Mirae Asset Global Strategist (GSO),'s pioneering plan worked in the background. Chairman Park provides important advice on the group's overseas business, emphasizing long-term values and emphasizing a global investment philosophy based on innovation and market-leading potential. Analysts say that Chairman Park's strategy and independent and systematic management of the securities company's management have exerted synergy.

Mirae Asset Securities is expected to further strengthen its position in the global market based on its global network and strong capital. In fact, Mirae Asset Securities' total capital in the first quarter was 12.3338 trillion won, an increase of nearly 5 trillion won compared to 2023. Since the acquisition of local securities firms in India, it has secured 5.2 million accounts, 130 branches, 3,700 employees, and 4,400 partners to rank ninth in terms of local active customers, while Mirae Asset Securities' overseas customer assets (AUM) soared from KRW 16 trillion to KRW 70 trillion. As a result, the market is predicting that Mirae Asset Securities' growth curve may be steeper than expected.

Mirae Asset Securities plans to expand its presence in the global market by pursuing continuous innovation without settling for the present. It plans to maximize profits through cooperation with global bases within the group, strengthen local internal control systems, and develop customized asset management services using AI (artificial intelligence) technology to increase competitiveness.

|

This article was translated by Naver AI translator.