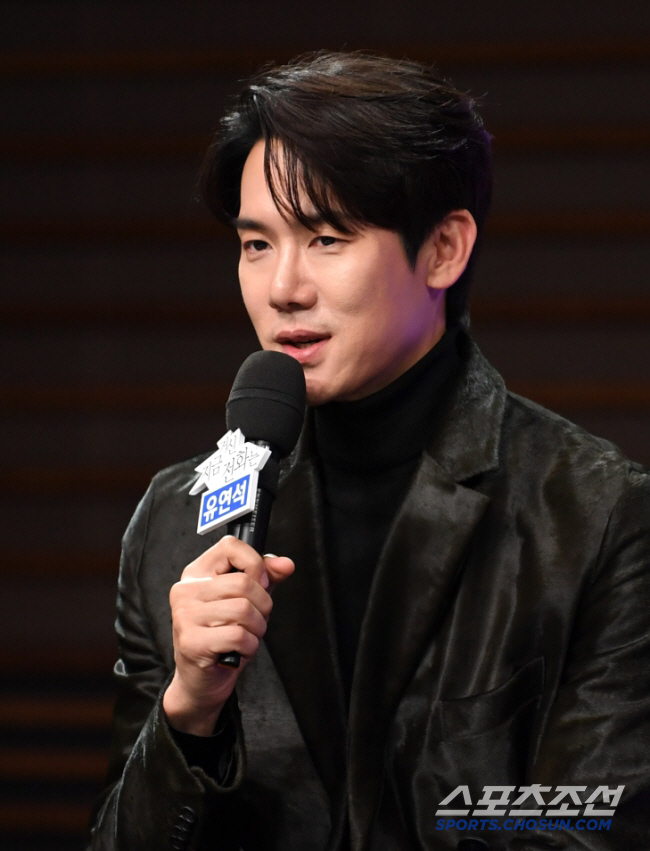

Yoo Yeon-seok, 7 billion won in tax evasion controversy..It's unfair to raise an objection to the IRS.

Mar 14, 2025

|

According to a CBS No Cut News report on the 14th, the National Tax Service recently notified Yoo Yeon-seok that it will conduct a high-intensity tax investigation and impose about 7 billion won in taxes, including income tax. This is an amount that far exceeds the amount of Lee Ha-ni's additional collection, which was recently collected 6 billion won in tax.

Yoo Yeon-seok established his representative entertainment agency, Forever Entertainment, and the National Tax Service judged that there was a tax problem in the process and conducted a high-intensity tax investigation.

However, Yoo Yeon-seok objected to the decision of the National Tax Service and requested a pre-taxation review in January. It refers to a kind of objection procedure that a taxpayer claims when he or she has an objection to the action of the tax authorities.

In this regard, Yoo Yeon-seok told CBS No Cut News that "the process of recalculating the amount of tax paid through a full tax review is in progress."We will actively explain the issues related to the interpretation and application of the law in accordance with due process, and it is not finally confirmed or notified."

Yoo Yeon-seok's position is that he will actively explain the review process to correct the new amount. It also added that the 7 billion won imposed through the clarification process will be significantly lowered to 3 billion won.

|

Lee Ha-nee has recently been embroiled in suspicions about the source of 6.5 billion won in real estate purchase funds following rumors of tax evasion of 6 billion won.

Last month, it was belatedly known that Lee Ha-nee received a high-intensity tax audit and paid a large amount of additional fines amounting to 6 billion won. In response, Lee Ha-nee's agency Tim Hopp said in an official position that `Lee Ha-nee has faithfully fulfilled his duty of tax payment by complying with laws and procedures under the advice of his tax agent. The tax was paid in full as an additional tax due to the difference in perspective between the tax authorities and tax agents, and had nothing to do with deliberate omission of taxes, he explained.

yaqqol@sportschosun.com