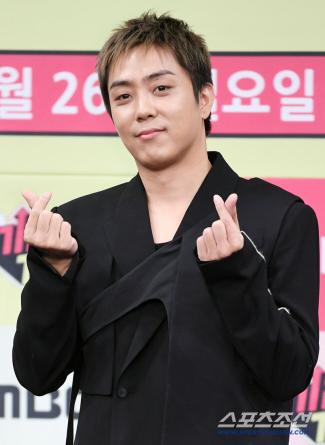

Yoo Jae-seok, the first owner of the property, is surprised to pay tax accountants why they cannot find tax evasion even if they are robbed

Aug 26, 2025

|

On tax-saving TV conducted by a professional tax accountant, Yoo Jae-seok revealed the real reason why he has never been caught in a high-intensity tax investigation.

Yoon Na-gyeom, a tax accountant, said "It is common for celebrities to file a bookkeeping report as a private business entity. It is a method of hiring a tax accountant to organize and process all income and expenditures, which has a great tax reduction effect, but has the disadvantage of being complicated.' The second method is to report the standard expense rate (estimated report). This is a simple way to pay more taxes, reflecting only the rate set by the state. Yoo Jae-suk chose the method of reporting the estimate. Unlike most celebrities, they chose the standard expense ratio method of 8.8%. For example, if you earned 10 billion won and organized it into books and saved taxes, you would pay about 2.7 billion won in taxes, but the estimate reporting method used by Yoo Jae-seok would have to pay 4.1 billion won. In other words, he explained that he paid about 1.4 billion won more.

Regarding the reason and effectiveness of Yoo Jae-seok's choice to report the expense ratio, "As a national MC, it is a rise in credibility due to blocking tax controversy and strengthening credibility. In addition, it has the advantage of saving time and energy and focusing only on broadcasting without the stress of evidence and book management" It also has the effect of eliminating the risk of tax audits".

In conclusion, "Yoo Jae-seok is an exceptional case of choosing trust over money" "The judgment is that in the long run, image and trust become more valuable. This is a Novles Oblivion practice and a responsible choice as a national MC.

"Celebrities usually report that they made less money than I actually made by treating personal expenses as business expenses or hiring family members as employees to give more money," Yoon said. "The fact that Yoo Jae-seok was not caught in the tax audit means that he did not catch such expenses in the first place. From a tax accountant's point of view, Yoo Jae-seok not only has no more taxes to pay, but rather has to refund them."

lyn@sportschosun.com