AI ultrasonic drags medical image storage and transmission system...Production and exports of digital medical devices surged last year

May 28, 2025

|

According to the Ministry of Food and Drug Safety, as a result of analyzing the results of domestic medical device production, import, and export in 2024, the production and export of `Digital Medical Devices' increased by 32.4% and 45.4%, respectively, compared to the previous year. Total medical device production and exports, which fell in 2023, also rebounded, increasing 1.0% and 1.4% year-on-year.

▲Software-oriented digital medical devices continue to grow ▲ Medical device production and exports rebound ▲ Medical device export market diversification ▲ 1st place for dental implant production and export for 2 consecutive years ▲ 1st place for daily wear soft contact lens imports for 2 consecutive years ▲ Increasing number of manufacturers, importers and workers of medical devices in 2024 were cited as major characteristics of medical device production, import and export performance.

According to the Digital Medical Products Act, which took effect in January this year, the production, export, and import of digital medical devices in 2024 are KRW 547.2 billion, KRW 456.3 billion, and KRW 265.9 billion, respectively. Production and exports increased to 32.4% and 45.4% year-on-year, respectively, while imports fell 4.4%. As the total amount of production more than doubled the amount of imports, it was analyzed that the growth of software-oriented digital medical devices based on domestic ICT technology continued.

In particular, the ultrasonic image diagnosis device with AI technology ranked first in production and export of digital medical devices, followed by the medical image storage and transmission system (PACS) used for transmitting and storing medical images, followed by the second in production and export. The third in production was 'AI-based bio-signal analysis standalone digital medical device software', and the third in export was 'Dental medical image analysis standalone digital medical device software'.

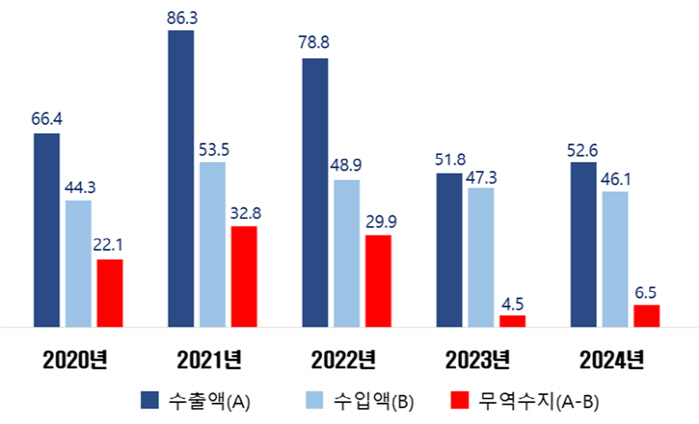

Last year, domestic medical device production and exports increased 1.0% and 1.4% year-on-year to KRW 11.426.7 trillion and KRW 7.17 trillion, respectively, and production and exports, which had declined due to a sharp drop in demand for diagnostic devices at home and abroad since the COVID-19 pandemic (May 2023), rose again. Imports fell 2.7 percent year-on-year to 6.287.7 trillion won.

Last year, the medical device industry's trade balance rose 43.7% year-on-year to 882.3 billion won, marking the fifth consecutive year in the black.

The size of the domestic medical device market in 2024 was KRW 10.54 trillion, down 1.7% from the previous year (10.727 trillion won), but it showed an annual average growth rate of 8.8% over the past five years.

General medical device production was KRW 10.42 trillion and exports were KRW 6.22 trillion, up 3.0% and 5.5%, respectively, from the previous year, and maintained growth for five years since 2020.However, as global demand for COVID-19-related items such as 'high-risk infectious disease immunoassay reagent' decreased, the production amount of in vitro diagnostic medical devices decreased by 15.8% and 19.1%, respectively, to KRW 997.3 billion and KRW 949.7 billion in exports.

Over the past five years, dental implant production and exports have increased at an annual average of 19.7% and 25.3%, showing steady growth. In particular, 'Dental implant stagnation' ranked first in production and exports for the second consecutive year. On the other hand, the No. 1 import in 2024 was 'Soft Contact Lenses for Daily Wear' following last year, an annual average increase of 12.0% over the past five years.

In 2024, exports from the United States, China, Russia, and Japan, major exporters, fell 4.4% year-on-year to 38.8% ($2.04 billion), while exports from Europe, South America, and ASEAN countries such as Germany, Brazil, Thailand, and Vietnam increased, showing a trend of diversifying the medical device export market.

This article was translated by Naver AI translator.