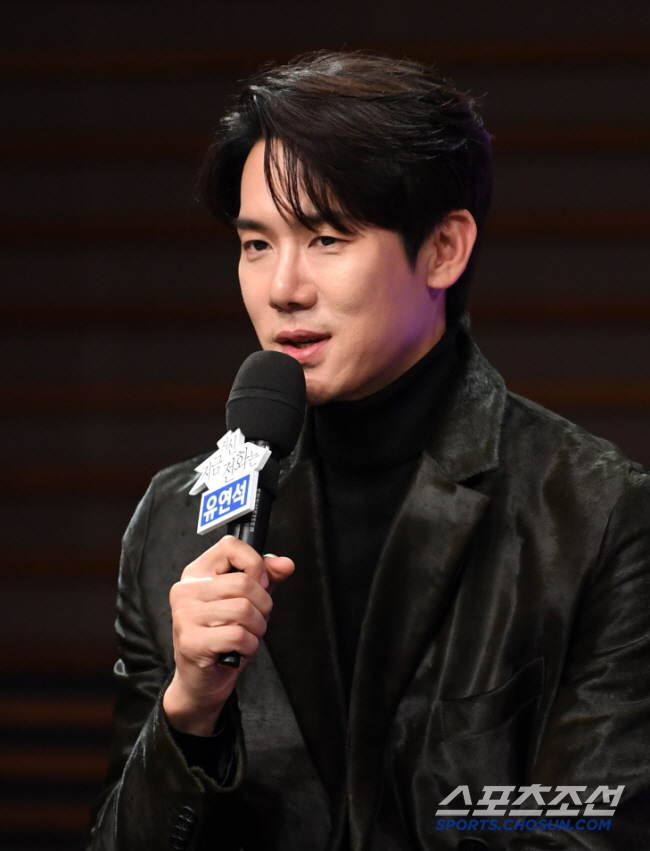

Yoo Yeon-seok Clarifies 3 Billion Won Tax Issue

Apr 10, 2025

|

King Kong by Starship, Yoo Yeon-seok's agency, announced on the 10th that `As a result of the active clarification in accordance with due process, the amount of tax imposed was redefined after double taxation was recognized through the pre-taxation review.'"Excluding the previously paid corporate tax and VAT, Yoo Yeon-seok's tax has been fully paid around KRW 3 billion.'

Since 2015, Yoo Yeon-seok has developed and produced YouTube contents as an extension of his entertainment activities, and established a corporation for the purpose of additional business and restaurant business. This was considered to be the subject of personal income tax payment, not corporate tax, and it occurred when comprehensive income tax was imposed, and tax trials and legal procedures are being prepared for issues related to legal interpretation and application.

He emphasized that `this taxation is not for tax evasion or evasion purposes, but for a difference of opinion on the interpretation and application of tax laws.'."

Earlier last month, the National Tax Service announced that it would impose about 7 billion won in taxes, including income tax, as a result of an intensive tax investigation into Yoo Yeon-seok. This is an amount that far exceeds the amount of Lee Ha-ni's additional collection, which was recently collected 6 billion won in tax.

However, Yoo Yeon-seok objected to the decision of the National Tax Service and requested a pre-taxation review in January. It refers to a kind of objection procedure that a taxpayer claims when he or she has an objection to the action of the tax authorities.

In this regard, Yoo Yeon-seok said, "The process of recalculating the amount of tax paid through a full tax review is in progress." and "We will actively explain the issues related to the interpretation and application of the law in accordance with due process, and it is not finally confirmed or notified.""

The following is the full text of Yoo Yeon-seok's statement

This taxation is not for the purpose of tax evasion or evasion, but due to differences in opinions on the interpretation and application of tax laws. As a result of active clarification in accordance with due process, the amount of tax imposed was redefined after double taxation was recognized through a pre-taxation review, and the actual tax paid by actor Yoo Yeon-seok was paid about 3 billion won, excluding pre-paid corporate tax and VAT.

Since 2015, actor Yoo Yeon-seok has developed and produced YouTube content as an extension of his entertainment activities, established a corporation for the purpose of additional business and restaurant business based on it, and conducted various activities. This is an issue that occurred when comprehensive income tax was imposed, not corporate tax, and tax trials and legal procedures are being prepared for issues related to legal interpretation and application.

Actor Yoo Yeon-seok has made fulfilling his sincere tax obligations a top priority, and as a member of the people, he will continue to thoroughly comply with relevant laws and procedures and fulfill his responsibilities.

yaqqol@sportschosun.com